The purpose of the Public Service Commission is to ensure fair and prompt regulation of public utilities; to provide for adequate, economical and reliable utility services throughout the state; and to appraise and balance the interests of current and future utility service customers with the general interest of the state's economy and the interests of the utilities.

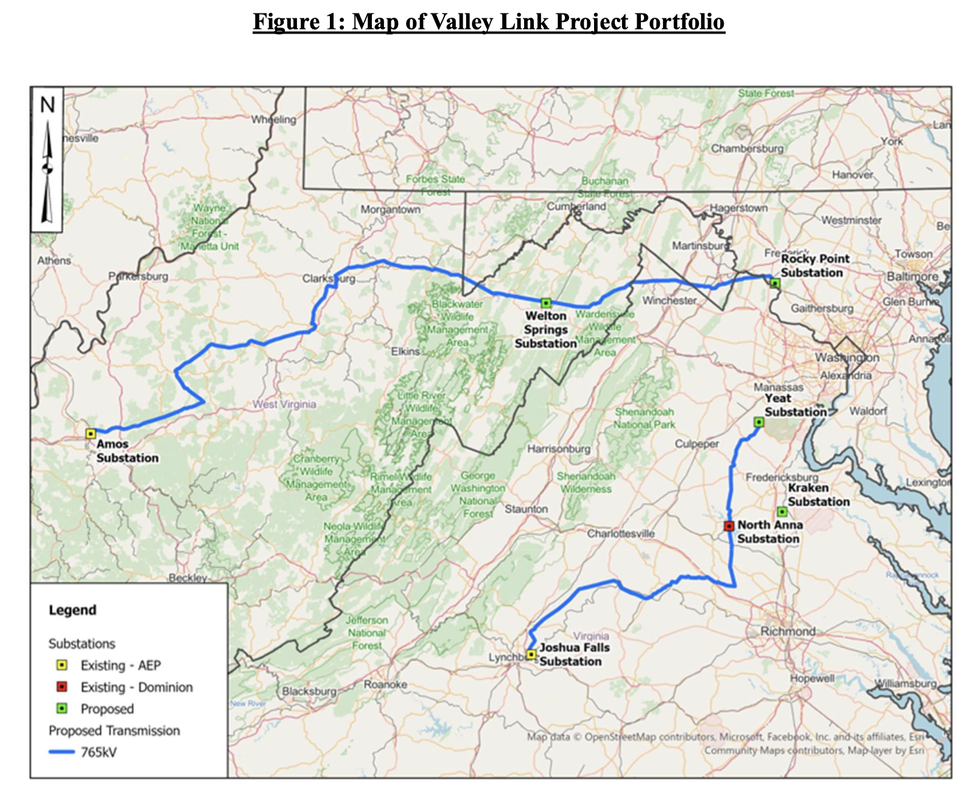

Thank you for contacting the Public Service Commission of West Virginia regarding the transmission line project. We are aware of plans for the proposed transmission line, but have not yet received a filing in this matter. We expect the developer to apply to the PSC for a certificate of convenience and necessity (under code section 24-2-11a) before beginning any construction. Once the PSC receives the application, there will be a public notice (the law requires newspaper publication in counties where the line is proposed to be located) and an opportunity for the public to comment and to file protests and to ask for the PSC to hold a hearing. We encourage you to share your comments once a case has been opened and is available for public input.

This section of state code that got amended back in 2010. It is WV Code §24-2-11a(c) available at this link:

https://code.wvlegislature.gov/24-2-11A/

It says: At least thirty business days before the deadline set by the Public Service Commission to file a petition to intervene with regard to the application, the applicant shall serve notice by certified mail to all owners of surface real estate that lie within the preferred corridor of the proposed transmission line. Notice received by a named owner who is the recipient of record of the most recent tax bill that has been issued by the county sheriff's office for a parcel of land at the time of the filing of the application is sufficient notice regarding that parcel for purposes of this subsection.

I have the right to intervene as an impacted citizen. I also have a right to intervene and participate in the case, not just file a comment.

You do have a right, as any citizen does, to ask to intervene in any case before the Commission.

However, in this case, there is no case before the Commission, so therefore we cannot take or act upon your request.

Until the company files a petition seeking our approval of the line, there is no case. That has not been filed by the company.

If such a request is filed, we will be happy to notify you and then you can petition to intervene.

In the meantime, I may suggest you file your protest with the company.

I hope this helps. Please feel free to call me at any time if I can be of assistance.

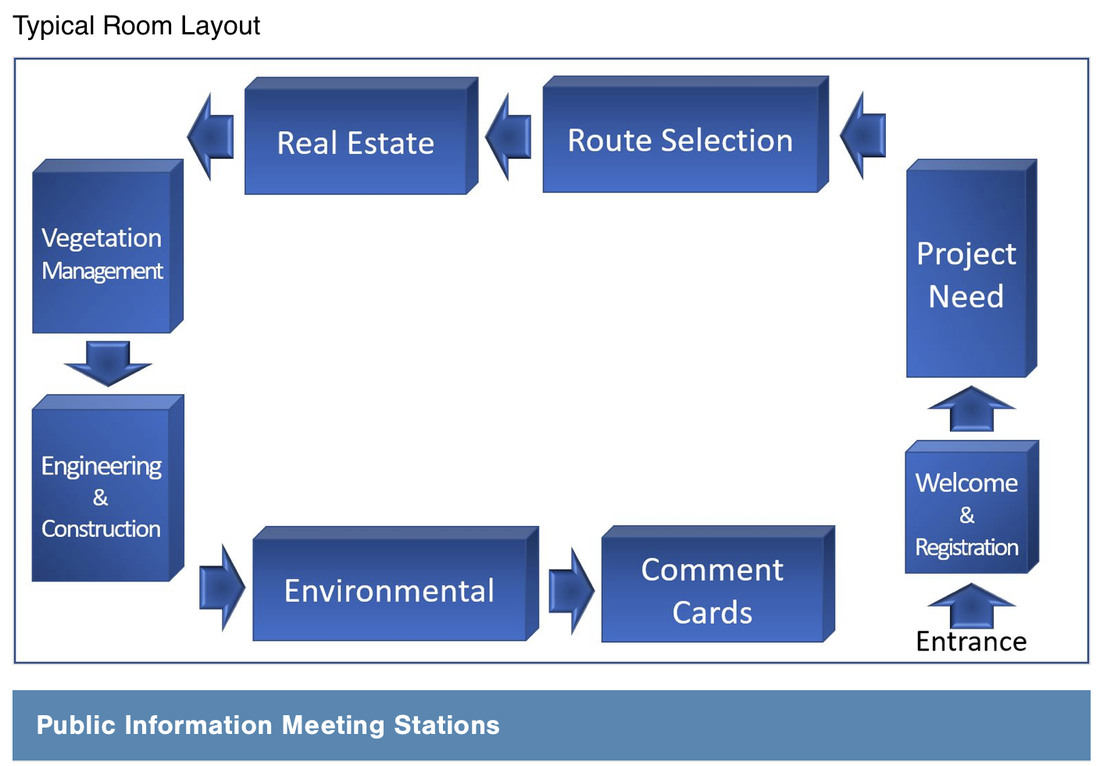

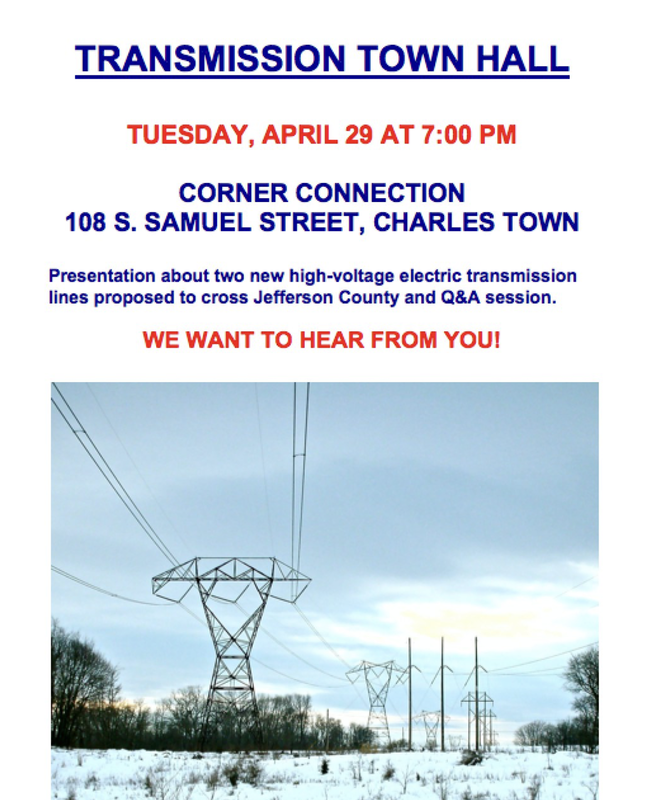

Furthermore, a different segment of the same transmission project has absolutely failed to provide effective engagement with other impacted landowners. NextEra has been holding "Open House" meetings in West Virginia that leave landowners confused and angry. The meeting setup is loud and confusing. The maps are not labeled. The comment cards cannot be filled out later and mailed in. Attendees cannot have normal conversation with project representatives because they cannot hear what they are saying and answers are non-responsive or misleading. The company's website is devoid of meaningful explanation or information about this project.

The 500kV MARL project is failing at public engagement on all fronts.

But yet when consumers go to the officials who are supposed to protect them from predatory and outrageous behavior by the public utilities it regulates, they get told their comments cannot be accepted.

In the case of FirstEnergy, impacted landowners and consumers do not even have a contact for the company in order to "file your protest with the company." Landowners are being preyed upon and nobody is stepping up to protect them.

Keep filing your general comments with the WV PSC, even though they claim they cannot accept them. And keep a record of your correspondence. Please forward any refusal of the PSC to accept your comment to your state delegates and senators and ask for their help. These public servants work for us!

To file a general comment with the WV PSC, go to this link and fill out the form. Maybe if they receive enough comments about the outrageous behavior of regulated public utilities they will have to do something?

Landowners are not just asking to intervene before an application is filed. They are commenting on the current process before the application is filed. Communities deserve an open and transparent process leading up to the filing of an application and they deserve to have their right to information protected by the Public Service Commission. After all, that is the PSC's mission!

Keep filing your comments with the PSC regarding your concerns with public engagement (or lack thereof). The PSC has rules that must be followed. The least it can do is accept and acknowledge your comments about these major transmission projects that have been proposed to cross our state. Let them know what you think about what's happening now, even if an application has not yet been filed. Don't let them pass the buck!

RSS Feed

RSS Feed